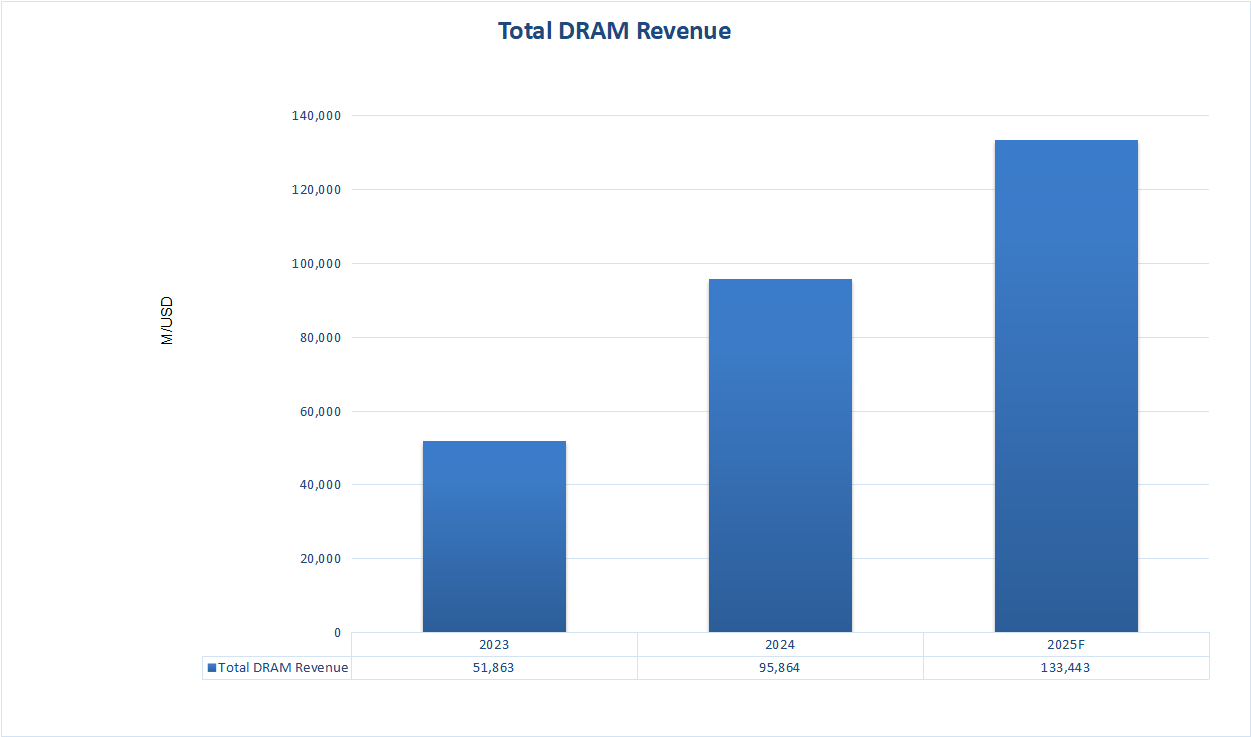

The worldwide DRAM market revenue is expected to grow significantly, reaching $133.4 billion in 2025, which is up 40% compared to the previous year. Leading memory manufacturers saw strong profit growth: SK Hynix operating profit surged 42.4% with a record 54% operating margin in Q1, Samsung profit grew 25.7%, and Micron profit increased 33.3%.

Demand varied greatly: Production of High Bandwidth Memory (HBM) for AI servers jumped 36.6%, now making up over 35% of total production capacity. Shipments of mobile DRAM grew 20.3% due to recovering smartphone and PC markets, with DDR5 adoption accelerating in PCs. As AI chips used up advanced manufacturing capacity, the DRAM supply-demand gap worsened to -1.4% (from -0.2% in 2024), causing quarterly contract prices to rise (Q4 up 5.3% compared to Q3). HBM kept a price premium of over 30%, helping drive a 20% increase in the average selling price (ASP) for the full year. Notably, amid this industry shift, DDR4—the previous-generation mainstream product—has unexpectedly surged in the past three months, with its price escalation outpacing even some cutting-edge solutions.

The semiconductor industry is experiencing significant disruptions due to a shortage of DDR4 memory. According to the latest data from TrendForce, spot prices for standard 8Gb DDR4 chips have risen unexpectedly over the past three months: from a baseline of $1.63 in March, 2025 to $3.775 by mid-June, representing a cumulative increase of 132%. Notably, the price jumped 8% on June 11 alone, the biggest single-day change since 2015. This price level is now higher than previous peaks seen before the 2022 memory market downturn.

This surge is primarily driven by strategic capacity reductions by the world’s three largest memory suppliers—Samsung Electronics, Micron Technology, and SK Hynix. Samsung Electronics has confirmed it will fully exit consumer-grade DDR4 production by year-end, reducing monthly output by 120,000 wafers at its Hwaseong plant in South Korea. Micron Technology will cut wafer starts by 56% at its Taiwan facility in Q3, while SK Hynix is accelerating the transition of its Wuxi fab to High Bandwidth Memory (HBM) production. Industry analysts estimate these moves have reduced global DDR4 supply by 52% year-over-year.

| Manufacturer | DDR4 Reduction/Discontinuation Plan | Transition Direction | Key Timeline |

|---|---|---|---|

| Samsung | Discontinue 8GB/16GB modules by end-2025; phase out 1y-nm process first | Double HBM capacity + DDR5/LPDDR5 expansion | Final shipment date: Dec 2025 |

| SK Hynix | Cut DDR4 production share from 30% to 20% | HBM (25% of revenue) + Enterprise-grade SSDs | End of 2025 |

| Micron | Halt older-process DDR4 for servers; maintain limited consumer-grade supply | DDR5 & HBM3E scale-up | Mid 2025 |

Despite the accelerated migration to DDR5 in consumer electronics, specific industries still rely irreplaceably on DDR4. Research shows that the global DRAM market reached approximately $95.8 billion in 2024, with DDR4 ccounting for 40%($38.9 billion). Within the automotive sector, stable demand from applications such as ADAS (Advanced Driver Assistance Systems) and in-vehicle infotainment systems drove the global automotive DRAM market to around $3.5 billion in 2024, where DDR4 dominated with a share over 70% ($2.8 billion). In the industrial sector, the market size reached approximately $2.8 billion in 2024, driven by price-inelastic demand from applications such as smart manufacturing equipment and industrial robotics, whereas DDR4 captured over 80% market share.

Changes in international trade policies have also increased market instability. The expiration of the U.S. 7% tariff waiver on Chinese semiconductors on July 31 has caused companies to build up inventory early. Logistics data from Hong Kong trader Luckytech shows DDR4 inventory turnover days have dropped sharply from 45 to 9. At the same time, Taiwan-based supplier Nanya Technology stopped giving long-term agreement (LTA) price quotes in May, making market tensions worse.

Amidst this supply-constrained landscape, OSCOO emerges as a qualified supplier of various DRAM modules for different needs. We offer comprehensive memory solutions spanning from DDR3 and DDR4 to cutting-edge DDR5 generations. Freely select capacities ranging from mainstream 8GB to generous 32GB, effortlessly meeting diverse needs—from daily office tasks, HD multimedia, and professional content creation to demanding AAA gaming.

Long-term market restructuring is underway. TrendForce projects DDR5 penetration in PCs will exceed 80% by 2026, phasing out consumer DDR4 from mainstream channels. Nevertheless, DDR4 will persist in automotive and industrial automation due to certification cycles.