В августе-сентябре 2025 года на мировом рынке памяти DDR4 наблюдалась беспрецедентная волатильность. Впервые цены на DDR4 превысили цены на DDR5, что привело к редкому явлению инверсии цен. Эта ненормальная ситуация заставила крупнейших гигантов рынка памяти пересмотреть свои продуктовые стратегии, что привело к значительным изменениям в спросе и предложении на рынке.

Инверсия цен: Редкое явление на рынке DDR4

С июня 2025 года цены на память DDR4 стали заметно превышать цены на DDR5. Согласно данным TrendForce, спотовая цена 16 Гб DDR4 выросла с $7,01 в июне до $8,59 в августе, то есть на 22,5%. За тот же период цена на продукты DDR5 той же емкости выросла лишь незначительно - с $5.85 до $6.17, рост составил 5.5%. К концу августа ценовой разрыв между ними продолжал увеличиваться, и цена DDR4 была примерно на 39% выше, чем DDR5. Такая инверсия цен сохраняется уже почти три месяца. Аналитики рынка отмечают, что подобная ситуация крайне редка в индустрии памяти: последний раз подобное происходило при переходе от DDR2 к DDR3.

Ответы крупнейших производителей: Различные стратегии

В ответ на изменения рынка три крупнейших производителя памяти приняли различные стратегии. Samsung Electronics и SK Hynix скорректировали свои планы по прекращению производства, продлив выпуск DDR4 до 2026 года. SK Hynix также уведомила клиентов о том, что увеличит выпуск DDR4 на своем старом заводе по производству пластин в Уси. Это решение рассматривается в отрасли как типичная корректировка рынка, обусловленная в первую очередь соображениями прибыли. Micron Technology, напротив, придерживается своего первоначального плана по прекращению производства. Компания выпустила уведомление об окончании срока службы DDR4 и LPDDR4 для клиентов в июне 2025 года и, как ожидается, прекратит соответствующие поставки в течение ближайших двух-трех месяцев.

Многочисленные факторы, вызывающие дисбаланс спроса и предложения

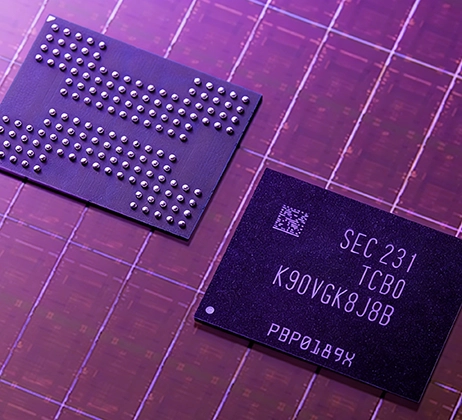

Одним из ключевых факторов, приводящих к ограничению поставок DDR4, является сжатие HBM производственные мощности. Применение Al привело к резкому росту спроса на память с высокой пропускной способностью, на производство которой уходит примерно в три раза больше пластин, чем на стандартную DRAM.

Сокращение предложения на рынке также связано с тем, что китайские производители сместили акценты. Китайские производители DRAM, такие как CXMT, объявили о прекращении производства DDR4 в 2025 году, ускорив переход на DDR5.

Завершение амортизации оборудования сделало дальнейшее производство DDR4 высокорентабельным. Оборудование для старых производственных линий DDR4 полностью амортизировано, что привело к очень низким предельным затратам. В условиях нынешних высоких цен продолжение производства DDR4 стало чрезвычайно привлекательным бизнесом.

США исключили завод Samsung в Сиане, завод SK Hynix в Уси и завод Intel в Даляне из списка утвержденных конечных пользователей, что помешало планам расширения Samsung в Сиане и SK Hynix в Уси.

Перерабатывающие отрасли испытывают давление со стороны поставщиков

Ограниченные поставки DDR4 уже сказались на последующих отраслях. Производители комплектующих для ПК столкнулись с дефицитом, что вынудило их сократить производство и продажи моделей DDR4 и ускорить переход на решения DDR5. Многие производители, не сумев обеспечить достаточный объем поставок, были вынуждены увеличить долю моделей DDR5. Рынок памяти DDR4 для ПК сейчас характеризуется ростом цен и снижением объемов. На рынке смартфонов широкий спектр моделей низкого и среднего ценового диапазона по-прежнему использует в основном LPDDR4X. По мере того как американские и корейские производители сокращают или прекращают поставки LPDDR4X, на рынке нарастает паника. Дисбаланс спроса и предложения в секторе бытовой электроники еще более острый. Терминальный спрос приходится на промышленные системы управления, сети, телевизоры, бытовую электронику и контроллеры, где DDR4 является основной спецификацией памяти. Однако объемы поставок для этих приложений отстают от объемов поставок для ПК и серверов.

Перспективы на будущее: Инверсия вряд ли продлится долго

Отраслевые аналитики в целом считают, что текущая инверсия цен между DDR4 и DDR5 вряд ли сохранится в долгосрочной перспективе. Исторические данные показывают, что при переходе от DDR2 к DDR3 также наблюдался ценовой разворот продолжительностью около четырех месяцев, но по завершении технологического перехода рынок в конце концов вернулся к нормальному порядку. В долгосрочной перспективе жизненный цикл DDR4 уже превысил десять лет. Технологические итерации и рост числа Al-приложений будут и дальше стремительно двигать рынок в сторону DDR5 и HBM. Нынешние колебания цен могут быть лишь последним рывком для традиционных продуктов.