Nos últimos anos, a transição da DDR4 para a DDR5 foi muitas vezes considerada uma "queima lenta". Embora a DDR5 ofereça vantagens tecnológicas, a sua adoção foi travada por restrições de custo, compatibilidade e ecossistema. No entanto, na segunda metade de 2025, muitos sinais técnicos e de mercado estão a começar a apontar para uma nova realidade: a transição está a entrar numa fase crítica. Por outras palavras, a DDR5 está a sair da sua fase piloto e a DDR4 está a ser gradualmente eliminada.

Oferta e procura no mercado, e tendências de preços

Um dos sinais mais claros é a tendência de preços contra-intuitiva dos últimos tempos - a DDR4 da geração mais antiga é, em alguns casos, mais cara do que a DDR5.

De acordo com a TrendForce, prevê-se que os preços contratuais da DDR4 em outubro de 2025 aumentem mais de 10%, enquanto os preços à vista podem subir 15% ou mais. Entretanto, os preços contratuais e à vista da DDR5 também poderão aumentar, na ordem dos 10-25%. Simultaneamente, prevê-se que a oferta de DDR4 e LPDDR4 se torne mais restrita no segundo semestre de 2025, fazendo subir os preços.

Já no início de 2025, os preços spot das DDR4 começaram a aumentar. Alguns relatórios indicam que, a partir de maio de 2025, os preços das DDR4 aumentaram rapidamente - módulos como os de 8 GB registaram aumentos de cerca de 50%. Em junho, alguns chips DDR4 de 16 Gb foram cotados a preços tão elevados como $12,50 por chip (ou mesmo mais), enquanto os chips DDR5 de capacidade e velocidade comparáveis se mantiveram relativamente estáveis ou subiram mais lentamente. Este fenómeno - a norma mais antiga a tornar-se mais cara do que a mais recente - reflecte a tensão na oferta de DDR4 sob as pressões sobrepostas da migração.

Porque é que isto está a acontecer? No fundo, os principais fabricantes estão a reduzir gradualmente o processo e a capacidade das DDR4, reafectando recursos para as DDR5, HBMe outras soluções de memória avançadas. A TrendForce observa que a saída da capacidade DDR4 e os ajustes na estrutura de fornecimento são as principais causas dessa distorção de preços. Como a demanda de IA, nuvem e aplicativos de ponta está levando os fabricantes a favorecer produtos de maior valor, o DDR4 se torna mais um ato marginal ou de equilíbrio.

No que respeita às DDR5, os aumentos de preços continuam a ser mais moderados. A TrendForce prevê que a DDR5 poderá aumentar 3-8% no terceiro trimestre de 2025, enquanto a LPDDR5X poderá registar aumentos de 5-10%. Uma vez que o mercado global de DRAM continua a ser apertado, os fabricantes estão a concentrar a atenção na DDR5, HBM e outros segmentos premium, o que poderá manter a pressão ascendente sobre os preços da DDR5.

Em suma, as tendências da oferta e dos preços indicam que a DDR4 está a ser marginalizada, enquanto a janela de mercado da DDR5 está a abrir-se.

Evolução técnica e progresso do processo

Uma migração bem-sucedida não pode depender apenas de propaganda - uma base técnica sólida é essencial. A DDR5 não é simplesmente uma DDR4 mais rápida; introduz alterações na arquitetura, no controlo, na potência e na fiabilidade.

De um ponto de vista arquitetónico, a DDR5 introduz dois subcanais de 32 bits num único DIMM, melhorando a forma como a memória lida com o acesso simultâneo. Também incorpora um regulador de tensão no módulo, transferindo algumas responsabilidades de gestão de energia da placa-mãe para o próprio módulo. Isto ajuda a simplificar o design da placa-mãe e a melhorar a integridade do sinal.

Em termos de desempenho, a DDR5 pode ser escalada para frequências e larguras de banda mais altas. Os primeiros módulos DDR5 geralmente começam com 4800 MT/s como linha de base, mas a especificação DDR5 permite expansões para 6400, 7200 MT/s e além. As normas DDR5 em evolução do JEDEC também incluem ECC (correção de erros) integrado, mecanismos de atualização de vários níveis e técnicas melhoradas de equalização e sinalização para aumentar a estabilidade. Algumas propostas académicas (por exemplo, para atenuar o "row-hammer") estão mesmo a explorar protecções finas no âmbito da DDR5 para reduzir a sobrecarga de desempenho das medidas de estabilidade.

No entanto, estas melhorias têm custos: A maior complexidade da DDR5 exige melhores rendimentos e tolerâncias mais rigorosas, tornando-a inicialmente mais cara por unidade do que a DDR4. Consequentemente, os fabricantes que promovem a DDR5 precocemente têm de absorver maiores riscos de I&D e de rendimento.

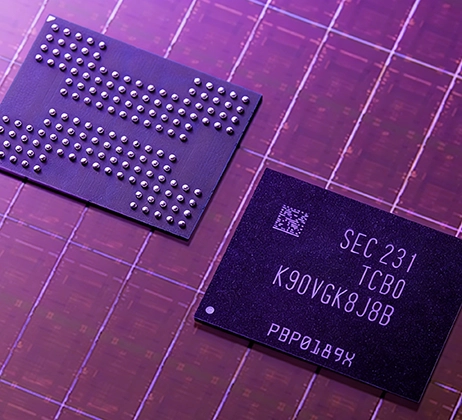

Do lado do processo, os principais fornecedores de DRAM (Samsung, SK Hynix, Micron, etc.) estão a conduzir a DDR5 para nós de processo mais avançados. Estão a trabalhar com nós 1γ / 1δ e mais além para aumentar a densidade e diminuir o consumo de energia. À medida que o rendimento do processo melhora, o custo por bit da DDR5 diminui, permitindo-lhe competir mais diretamente com a DDR4 em termos de preço.

É também importante notar que a DDR5 não é a única direção futura. A memória de alta largura de banda (HBM), a memória empilhada em 3D, a memória com extensão CXL e outras arquitecturas estão a ser desenvolvidas em paralelo. Em alguns casos de uso especializados ou de alta demanda, a DDR5 pode coexistir com essas tecnologias ou ceder a elas. No ecossistema de memória mais amplo, é provável que a DDR5 desempenhe o papel de "memória principal de uso geral + taxa de transferência média a alta" em vez de ser a solução extrema definitiva.

Estratégias do sector e dinâmica da cadeia de abastecimento

No percurso de migração, diferentes intervenientes desempenham diferentes papéis: há os primeiros a adotar, os seguidores cautelosos e os que são forçados a transformar-se.

Ao nível dos chips DRAM (Samsung, SK Hynix, Micron, etc.), a tendência é transferir recursos para a DDR5 e HBM, ao mesmo tempo que se elimina a DDR4. Reconhecendo que a DDR4 está a aproximar-se do fim do seu ciclo de vida, estas empresas têm de gerir a retirada de processos antigos enquanto investem fortemente em novos processos.

Dito isto, alguns fornecedores mais pequenos ou mais centrados na DDR4 (por exemplo, a Nanya) podem beneficiar a curto prazo da escassez da oferta de DDR4 e do aumento dos preços. Alguns relatórios sugerem que a Nanya tem estado ativa nas encomendas recentes de DDR4, ajustando a capacidade para responder à procura. Esta abordagem pode produzir ganhos a curto prazo, mas carece de sustentabilidade a longo prazo.

Os fabricantes de módulos, as marcas de memória e os ODM enfrentam o desafio de reestruturar as linhas de produtos. As marcas originalmente focadas em DDR4 precisam de desenvolver ofertas de DDR5. No período de transição, as linhas mistas de DDR4 + DDR5, os preços diferenciados, a diferenciação de desempenho, as soluções térmicas, as garantias de estabilidade e as funcionalidades de overclocking tornam-se alavancas competitivas.

Os fabricantes de placas-mãe, CPUs e plataformas têm um papel fundamental na adoção da DDR5. Muitos processadores e plataformas de nova geração assumem agora o suporte de DDR5, deixando efetivamente de lado a DDR4. Esses fabricantes de plataformas também precisam investir em BIOS, controladores de memória, ajuste de compatibilidade, otimização de tempo, integridade de sinal e garantia de estabilidade. Ao mesmo tempo, para ajudar os clientes existentes, alguns podem fornecer soluções compatíveis com as versões anteriores ou de fácil migração.

Os integradores de sistemas a jusante, OEMs e clientes finais também são partes interessadas importantes. Nesta fase crítica, eles devem tomar decisões de aquisição, inventário e posicionamento de produtos: devem adotar a DDR5 agora ou adiar a DDR4 para poupar custos? As configurações híbridas, as estratégias de comutação flexíveis e os designs de compatibilidade tornam-se tácticas essenciais.

Riscos e desafios

Embora a tendência da migração seja clara, o caminho está longe de ser isento de riscos.

Em primeiro lugar, o risco de custos e preços continua a ser importante. A DDR5 ainda se encontra numa fase de custos relativamente elevados; se o seu preço for demasiado elevado, a aceitação pelo mercado de massas poderá estagnar. Mesmo que os custos baixem, continua a ser incerto se os preços de mercado seguirão o mesmo ritmo.

Em segundo lugar, as preocupações com a compatibilidade e a estabilidade são reais. Durante a transição, as placas-mãe, os controladores de memória, o BIOS, os drivers, o ajuste de tempo e a integridade do sinal são todos pontos de falha potenciais. Os primeiros módulos DDR5 podem sofrer problemas inesperados de estabilidade ou compatibilidade; uma má experiência inicial pode diminuir a confiança dos utilizadores e atrasar a adoção.

Em terceiro lugar, os estrangulamentos no fornecimento e na produção podem atrasar o progresso. Se a aceleração do processo DDR5 for mais lenta do que o esperado, ou se os principais materiais e equipamentos sofrerem restrições, a transição atrasar-se-á. Além disso, a manutenção de processos antigos para a DDR4 e o suporte à DDR5 introduzem concorrência de recursos e tensão estratégica.

Em quarto lugar, a aceitação do mercado e a concorrência de tecnologias alternativas representam uma ameaça. Alguns dispositivos de baixo custo, sistemas incorporados ou aplicações industriais podem continuar a depender da DDR4 ou de memórias de nível inferior. Até que os perfis de custo e energia da DDR5 se normalizem totalmente, essas aplicações podem resistir à migração. Além disso, tecnologias como a memória estendida CXL, arquitecturas de memória heterogéneas e integrações de computação na memória ou memória + processamento podem desafiar o domínio da DRAM padrão.

Por último, os ciclos macroeconómicos, os ajustamentos das existências e as perturbações da cadeia de abastecimento ou das políticas são um risco. Os ciclos da indústria da memória são voláteis; as oscilações da procura, os excessos de existências, as políticas comerciais e os riscos da cadeia de abastecimento podem fazer descarrilar a dinâmica da migração.

Quando é que começa o "novo normal"?

Nesta fase de rutura, a questão crucial é: como saber quando é que o "ponto de inflexão" da transição chegou verdadeiramente? Podemos seguir vários indicadores:

- A velocidade de declínio da quota de capacidade e do volume de vendas da DDR4. Se entrarmos numa fase de descida rápida, isso significa que a DDR4 está a entrar numa fase de eliminação acelerada.

- A taxa de penetração e os fornecimentos de DDR5 estão a atingir um ponto de viragem, especialmente quando domina os principais mercados (PC, servidores, nuvem).

- A redução ou eliminação das diferenças de preço entre a DDR4 e a DDR5 - ou o desaparecimento de qualquer inversão de preços - é sinal de um mercado maduro.

- Os anúncios públicos dos fabricantes, os movimentos de capital, as alterações no planeamento da capacidade e as mudanças na carteira de produtos são também fortes indícios.

- É igualmente necessário ter em conta os mercados segmentados: os ritmos de adoção diferem entre os PC de consumo, os servidores/centros de dados e os sistemas incorporados/industriais.

Com base nos dados públicos actuais e nas projecções da indústria, é provável que este período crítico surja no final de 2025 até ao início de 2026. Isso significa que, a partir da segunda metade de 2025, a penetração da DDR5 em determinados segmentos pode acelerar e a saída da DDR4 tornar-se-á mais visível. Em meados de 2026, a DDR5 pode muito bem tornar-se a norma dominante, enquanto a DDR4 se retira para papéis marginais ou de nicho.

Conclusão e perspectivas

A transição da DDR4 para a DDR5 é muito mais do que "apenas uma memória mais rápida". Envolve complexidade técnica, reafectação de recursos, reestruturação do mercado e coordenação do ecossistema a jusante. Estamos agora num ponto de viragem estrutural: A DDR5 está a ganhar condições técnicas e de mercado para se expandir, e o espaço de sobrevivência da DDR4 está a diminuir.

Nos próximos 3 a 5 anos, a penetração da DDR5 passará das plataformas topo de gama para os segmentos mainstream, os custos diminuirão e o apoio do ecossistema reforçar-se-á. Entretanto, as aplicações de elevada largura de banda ou de ultra-alta densidade podem migrar gradualmente para HBM, arquitecturas de memória heterogéneas ou integrações de memória + computação. Por outras palavras, a DDR5 não é a fronteira final, mas um dos pilares fundamentais do futuro ecossistema de memória.